The impact of United States government sanctions on Huawei is continuing to hurt the company and dampen overall smartphone shipments in China, where it is the largest smartphone vendor, according to a new report by Canalys. But Huawei’s decline also opens new opportunities for its main rivals, including Apple.

Canalys says Apple’s performance in China during the fourth-quarter of 2020 was its best in years, thanks to the iPhone 11 and 12. Its full-year shipments returned to its 2018 levels, and it reached its highest quarterly shipments in China since the end of 2015, when the iPhone 6s was launched.

Overall, smartphone shipments in China fell 11% to about 330 million units in 2020, with market recovery hindered by Huawei’s inability to ship new units. Even though demand in China for Huawei devices remains high, the company has struggled to cope with sanctions imposed by the U.S. government under the Trump administration that banned it from doing business with American companies and drastically curtailed its ability to procure new chips.

In May 2020, Huawei rotating chairman Guo Ping said even though the firm can design some semiconductor components, like integrated circuits, it is “incapable of doing a lot of other things.”

This left Huawei unable to meet demand for its devices, but gives its main rivals new opportunities, wrote Canalys vice president of mobility Nicole Peng. “Oppo, Vivo and Xiaomi are fighting to win over Huawei’s offline channel partners across the country, including small rural ones, backed by huge investments in store expansion and marketing support. These commitments brought immediate results, and market share improved within mere months.”

Apple benefited from Huawei’s decline because the company’s Mate series is the iPhone’s main rival in the high-end category, and only 4 million Mate units were shipped in the fourth quarter. “However, Apple has not relaxed its market promotions for iPhone 12,” wrote Canalys research analyst Amber Liu. “Aggressive online promotions across e-commerce players, coupled with widely available trade-in plans and interest-free installments with major banks, drove Apple to its stellar performance.”

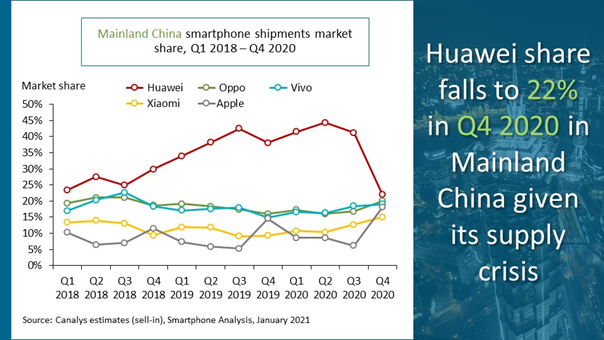

During the fourth-quarter of 2020, smartphone shipments in mainland China fell 4% year-over-year to a total of 84 million units. Even though it held onto its number one position in terms of shipments, Huawei’s total market share plummeted to 22% from 41% a year earlier, and it shipped just 18.8 million smartphones, including units from budget brand Honor, which it agreed to sell in November.

Huawei’s main competitors, on the other hand, all increased their shipments at the end of 2020. Oppo took second place, shipping 17.2 million smartphones, a 23% increase year-over-year. Oppo’s closest competitor Vivo increased its quarterly shipment to 15.7 million units. Apple shipped more than 15.3 million units, putting its market share at 18%, up from 15% a year ago. Xiaomi rounded out the top five vendors, shipping 12.2 million units, a 52% year-over-year increase.

Huawei’s decision to sell Honor means the brand may rapidly gain market share in 2021, since it already has consumer recognition, wrote Peng. 5G is also expected to help smartphone shipments in China, especially for premium models.

Recent Comments