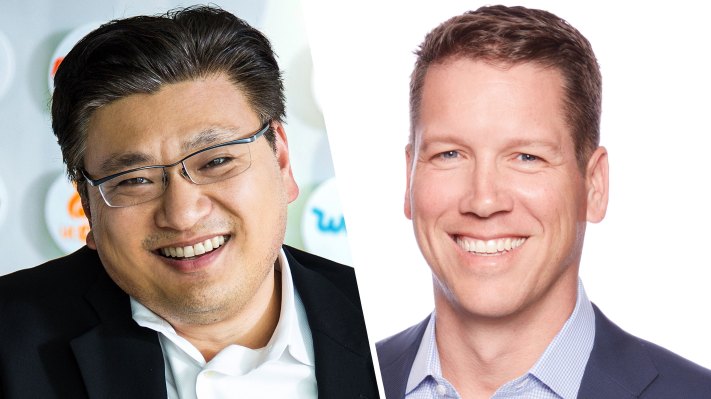

Earlier this week, GGV Capital’s Jeff Richards and Hans Tung joined TechCrunch for an Extra Crunch Live session. During our hour-long chat, we touched on startup profitability, the global venture capital scene, why GGV doesn’t have an office in Europe, how the venture industry is responding to its stark lack of diversity and other issues.

When it comes to useful bits of information, this was perhaps the most useful Extra Crunch Live discussion in which I’ve participated. One moment that stood out came early in the chat when we were talking about COVID-19-driven headwinds and tailwinds and how many startups might be in trouble. Richards said the following (emphasis via TechCrunch):

“You know, the one thing that’s been remarkable for me — I was in Silicon Valley as an entrepreneur in the ’99, 2000 dot-com bubble, and 9/11. I was here in ’08, ’09 — I think there is a level of resiliency in Silicon Valley that we did not have 10 years ago and 20 years ago. I don’t have data to point to that. But we have been saying now for a few months that we’ve been blown away at the level of maturity, calmness, perseverance [and] resiliency that our companies and the founders and management teams have. On an emotional level, it’s been very heartwarming, because you hope to back the kind of people that are building real companies that can withstand challenges.

I think the corollary to that is you’ve seen companies that raised a ton of money and were burning a ton of cash and weren’t building very good businesses, a lot of those frankly went under in Q1 or are going under now. They haven’t been able to raise more cash and they’re just kind of dead.”

Both Richards and Tung were positive about their own portfolio companies’ recent performance and financial health (cash position, really). But it appears that not only are their portfolios doing well, but other startups are a bit more solid than in previous downturns.

On the flip side, however, there is a separate cohort of startups that were running inefficiently before and are now perhaps unfundable. Reading both points in unison, it appears that the startup market is bifurcating between the companies that will come out of the COVID-19 era unwounded, and those that are suffering. And the companies that weren’t the most cash hungry probably have the highest chance of being in the first bucket.

There’s a lot more to get to. So hit the jump for the full video and audio, and a few more of the best bits from the transcript. (You can snag a cheap Extra Crunch trial here if you need one.)

Oh, and don’t forget to stay up to date on coming chats. There’s still a lot to do.

The full chat

Here’s the full video rewind. Our favorite bits of the transcript follow:

Recent Comments