Boston-based Apptopia, a company providing competitive intelligence in the mobile app ecosystem, has closed on $20 million in Series C funding aimed at fueling its expansion beyond the world of mobile apps. The new financing was led by ABS Capital Partners, and follows three consecutive years of 50% year-over-year growth for Apptopia’s business, which has been profitable since the beginning of last year, the company says.

Existing investors, including Blossom Street Ventures, also participated in the round. ABS Capital’s Mike Avon, a co-founder of Millennial Media, and Paul Mariani, are joining Apptopia’s board with this round.

The funding follows what Apptopia says has been increased demand from brands to better understand the digital aspects of their businesses.

Today, Apptopia’s customers include hundreds of corporations and financial institutions, including Google, Visa, Coca-Cola, Target, Zoom, NBC, Unity Technologies, Microsoft, Adobe, Glu, Andreessen Horowitz and Facebook.

In the past, Apptopia’s customers were examining digital engagement and interactions from a macro level, but now they’re looking to dive deeper into specific details, requiring more data. For example, a brand may have previously wanted to know how well a competitor’s promotion fared in terms of new users or app sessions. But now they want to know the answers to specific questions — like how many unique users participated, whether those users were existing customers, whether they returned after the promotion ended, and so on.

The majority of Apptopia’s business is now focused on delivering these sorts of answers to enterprise customers who subscribe to Apptopia’s data — and possibly, to the data from its competitors like Sensor Tower and App Annie, with the goal of blending data sets together for a more accurate understanding of the competitive landscape.

Apptopia’s own data, historically, was not always seen as being the most accurate, admits Apptopia CEO Jonathan Kay. But it has improved over the years.

Kay, previously Apptopia COO, is now taking over the top role from co-founder Eliran Sapir, who’s transitioning to chairman of the board as the company enters its next phase of growth.

Apptopia’s rivals like Sensor Tower and App Annie use mobile panels to gather app data, among other methods, Kay explains. These panels involve consumer-facing apps like VPN clients and ad blockers, which users would download not necessarily understanding that they were agreeing to having their app usage data collected. This led to some controversy as the app data industry’s open secret was exposed to consumers, and the companies tweaked their disclosures, as a result.

But the practice continues and has not impacted the companies’ growth. Sensor Tower, for example, raised $45 million last year, as demand for app data continued to grow. And all involved businesses are expanding with new products and services for their data-hungry customer bases.

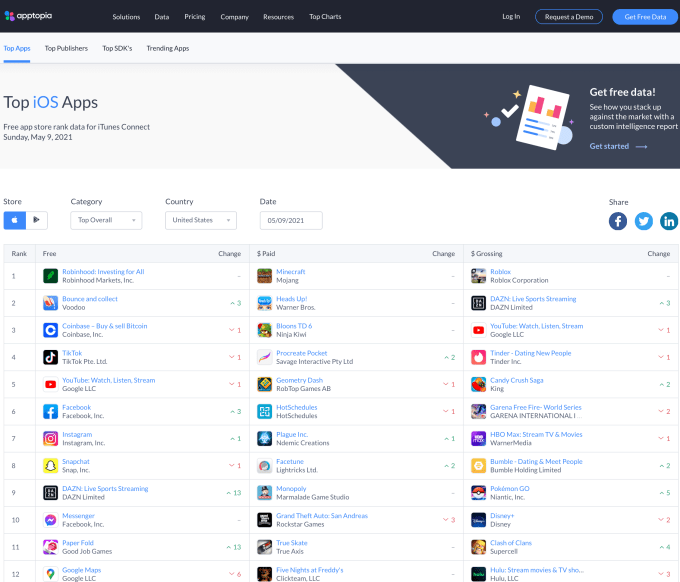

Image Credits: Apptopia

Apptopia, meanwhile, decided not to grow its business on the back of mobile panels. (Though in its earlier days it did test and then scrap such a plan.)

It gains access to data from its app developer customers — and this data is already aggregated and anonymized from the developers’ Apple and Google Analytics accounts.

Initially, this method put Apptopia at a disadvantage. Rivals had more accurate data from about 2016 through 2018 because of their use of mobile panels, Kay says. But Apptopia made a strategic decision to not take this sort of risk — that is, build a business that Apple or Google could shut off at any time.

“Instead, what we did is we spent years investing into data science and algorithms,” notes Kay. “We figured out how to extract an equal or greater signal from the same data set that [competitors] had access to.”

Using what Kay describes as “huge, huge amounts of historical data,” Apptopia over time learned what sort of signals went into an app’s app store ranking. A lot of people still think an app’s rank is largely determined by downloads, but there are now a variety of signals that inform rank, Kay points out.

“Really, a rank is just an accumulation of analytical data points that Apple and Google give points for,” he explains. This includes things like number of sessions, how many users, how much time is spent in an app, and more. “Because we didn’t have these panels, we had to spend years figuring out how to do reverse engineering better than our competitors. And, eventually, we figured out how to get the same signal that they could get from the panel from rank. That’s what allowed us to have such a fast-growing, successful business over the past several years.”

As Apptopia was already profitable, it didn’t need to fundraise. But the company wanted to accelerate its expansion into new areas, including its planned expansion outside of mobile apps.

Today, consumers use “apps” on their computers, on their smartwatches and on their TVs, in addition to their phones and tablets. And businesses no longer want to know just what’s happening on mobile — they want the full picture of “app” usage.

“We figured out a way to do that that doesn’t rely on any of what our competitors have done in the past,” says Kay. “So, we will not be using any apps to spy on people,” he states.*

[*Sensor Tower, in response to Kay’s statements, said the following: “We have never collected any personally identifying information (PII) on individual users, nor have we received any of the anonymous usage and engagement metrics our panel provides without user consent.”]

Apptopia was not prepared to offer further details around its future product plans at this time. But Kay said they would not rule out partnerships or being acquisitive to accomplish its goals going forward.

The company also sees a broader future in making its app data more accessible. Last year, for instance, it partnered with Bloomberg to bring mobile data to investors via the Bloomberg App Portal on the Bloomberg Terminal. And it now works with Amazon’s AWS Data Exchange and Snowflake to make access to app data available in other channels, as well. Future partnerships of a similar nature could come into play as another means of differentiating Apptopia’s data from its rivals.

The company declined to offer its current revenue run rate or valuation, but notes that it tripled its valuation from its last fundraise at the end of 2019.

In addition to product expansions, the company plans to leverage the funds to grow its team of 55 by another 25 in 2021, including in engineering and analysts. And it will grow its management team, adding a CFO, CPO and CMO this year.

To date, Apptopia has raised $30 million in outside capital.

Recent Comments